Are you looking for ideas about how to do a home renovation without dipping into your savings? If you don’t have a lot of money put away to finance a remodelling project, don’t worry. There are several viable options that you can consider. These include credit cards, personal loans, lines of credit, secured lines of credit and refinancing your mortgage. If you are considering a renovation in the near future, contact the interior design experts at Graham’s & Son. We will come right to your home to help advise you and give you a free consultation. We also offer on the spot quotes during our first visit.

“Dear Mr. Wayne Graham, May 2016 be the best year for the Grahams and their company! I must take this opportunity to thank you for the renovation job done on my house, not only the input idea that made my home more modernized, but the skill work that made the job done perfectly. I will not hesitate to refer you to my friends who may need a renovation on their house. Thank you again and have a healthy and prosperous year in 2016.”

Daniel Yu

Read More Customer Testimonials

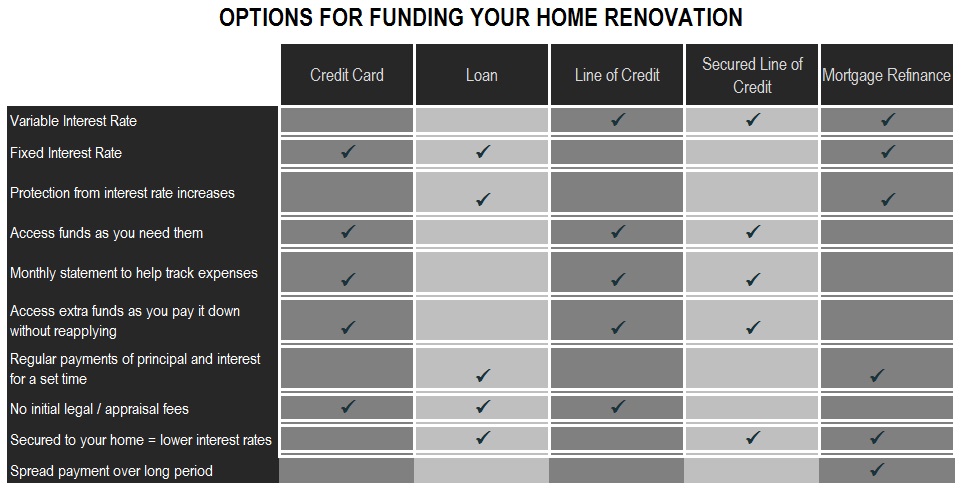

Options For Funding Your Home Renovation

You may wonder if you should even consider a renovation if you don’t have the money up front. It can actually be a good investment option because if it done well, it will add equity to your home. If you are planning to sell soon, it could help you to get a better price and sell it faster. There are many different options for financing your home renovation projects. The following chart gives you a quick comparison of the main ones and their features. Continue reading to find out more details about the advantages and disadvantages each option offers.

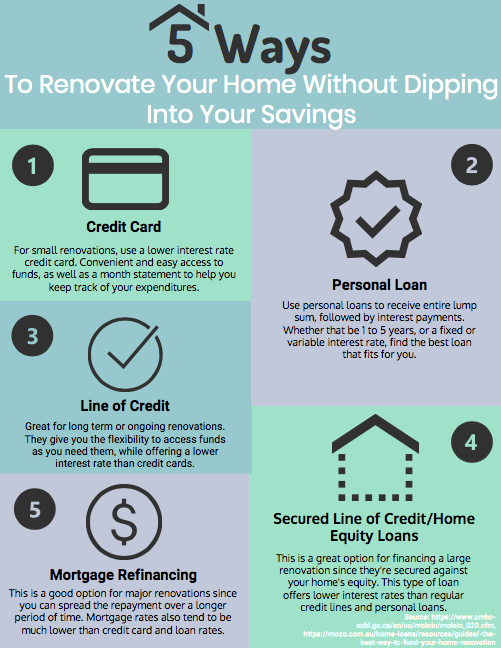

Credit Card

Funding your renovation using a credit could be an option, if you are doing a small renovation and don’t require large amounts of cash. Mozo.com recommends applying for a lower interest rate credit card possible, but remember that these cards usually come with a yearly fee. If you think you will have to carry the balance for a long time, you maybe should consider a lower interest rate financing option.

Advantages

- Convenient and easy access to funds as you require them

- Easy to apply for and easy to get approved

- Convenient for purchasing renovation materials online

- Convenient monthly statement to help you keep track of your expenditures

Disadvantages

- Interest rates on credit cards tend to be much higher than with other financing options – sometimes as much as 18 – 21%.

- Annual card fees for lower interest rate credit cards

Personal Loan

When you get a personal loan you are given the full amount in a lump sum and you pay interest on the entire amount. You are required to make regular payments of principal and interest over a set period of time. Most personal loan terms are one to five years, but in some cases, they may be slightly longer. You can also choose between a fixed or variable interest rate. A fixed interest rate is locked in and doesn’t change for the term of the loan, wile a variable rate moves up and down with the Prime interest rate. The interest rate that you are given will vary depending on your credit rating. It can be anywhere from 5% and up. To learn more about personal loans and how to apply for one, click here.

Advantages

- Usually you’re allowed to make lump sum payments without penalty

- Interest rate is lower than a credit card

- Can choose between a fixed or variable rate

Disadvantages

- Once the loan is paid off, you will need to reapply in order to access more funds

- Pay interest on the full amount of the loan even if you don’t use all of the money

- Interest rate is usually higher than a mortgage

Line Of Credit

Personal lines of credit are great for ongoing and long-term renovations as they give you the flexibility to access funds as you need them. You also benefit from lower interest rates than credit cards. To learn more about lines of credit, click here.

Advantages

- As you pay off your balance, you can use the funds again up to the credit line’s limit without having to reapply

- You only pay interest on the funds that you use

- Gives you a monthly statement to easily keep a record of your purchases

Disadvantages

- Harder to qualify for than a loan or credit card

- Interest rate will be slightly higher than with a secured line of credit

Secured Line Of Credit & Home Equity Loans

A Secured lines of credit or home equity loans are a great option for financing a large renovation project. They have all the benefits of regular credit lines and personal loans with the additional feature of being secured against your home’s equity. This security means that the lending institution can offer you a preferred, much lower interest rate than regular credit lines. According to the Canada Mortgage and Housing Corporation, you can normally borrow up to 80% of the value of your home.

Advantages

- Lower interest rates than regular credit lines and personal loans

- As you pay off your balance, you can use the funds again up to the credit line’s limit without having to reapply

- You only pay interest on the funds that you use

- Gives you a monthly statement to easily keep a record of your purchases

Disadvantages

- Usually required to pay legal and appraisal fees when it is initially set up

- Need to have some equity built up in your home in order to qualify

Mortgage Refinancing

A final option is to consider refinancing your current mortgage. This is a good option for major renovations as it allows you to spread the repayment over a longer period of time. Click here for a current listing of Royal Bank’s current mortgage rates. Canada Mortgage and Housing Corporation states on their website that you are generally allowed to borrow up to 80% of your home’s appraisal value minus any outstanding mortgage balance.

Advantages

- Payment is spread over a longer period of time

- Mortgage rates tend to be much lower than credit card and loan rates

Disadvantages

- Like a secured line of credit and home equity loan, you will probably have to pay the initial legal and appraisal fees

- Need to have some equity built up in your home in order to qualify

Why Choose Graham’s & Son For Your Home Renovation?

Graham’s & Son Interiors has been providing the highest quality interior design advice to its customers in the tri-city region for 40 years. We are experts in interior design and home renovations. You can trust us to listen to your ideas, give you sound advice, and help you through each step of your renovation project. We will even come right to your home with samples so you can see how they will look in your actual rooms. Contact us today to schedule your free in-home consultation.